b&o tax wv

Businesses choose which way to submit Tax returns. The City of Clarksburg has business and occupation tax charged on gross revenues of every entity conducting business within the corporate limits of this municipality.

Ranson Revenue From Rockwool Jefferson County Foundation Inc

101 East Washington Street Charles Town WV 25414.

. Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for. You will list all gross income for the appropriate filing period on the return. Tax Rates Contact Us Email Business and Occupation Tax Department.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline. For assistance call 3046965540 press option 4 for the Finance Division BO TAXES WAIVED FOR RETAIL.

EOTC-1 Schedule EOTC-1 Economic Opportunity. 323 or email the BO Tax Office. The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US.

Return by the due date to avoid delinquent notices and tax assessments. Business and Occupation Tax Overview Information on BO Taxes for Charleston WV. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline.

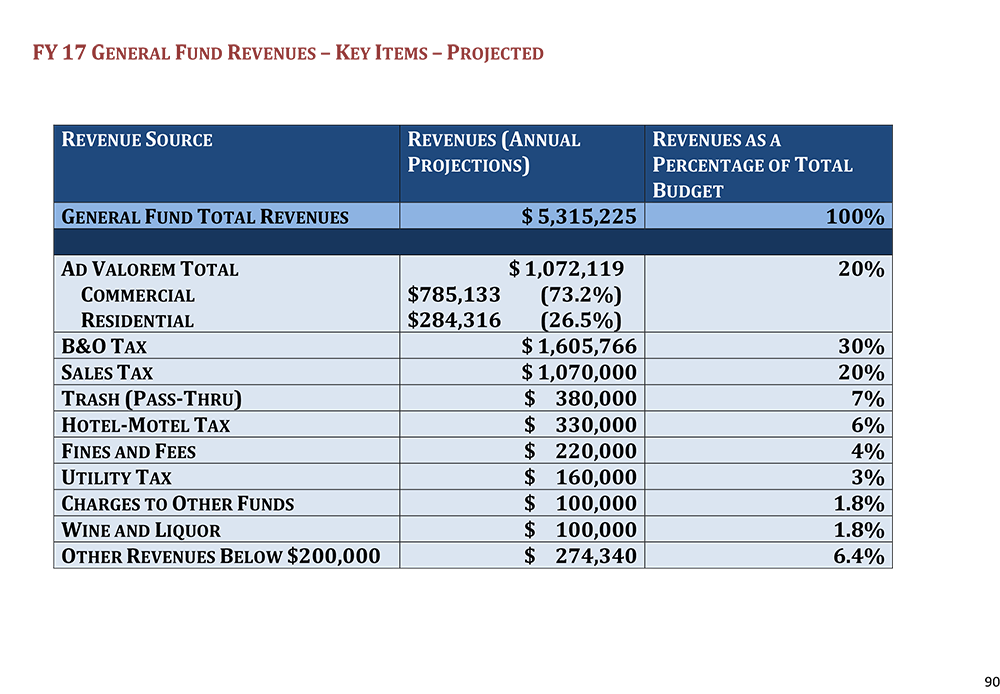

Rates Listed below is a breakdown of the current tax rate schedule for the Citys Business Occupation BO Taxes. For questions or concerns please contact the BO Tax Office at 304-366-6212 ext. Contractors working on one or more projects that have a contract amount more than 5000 must when paying BO Tax list each project name and the amount of each contract upon which.

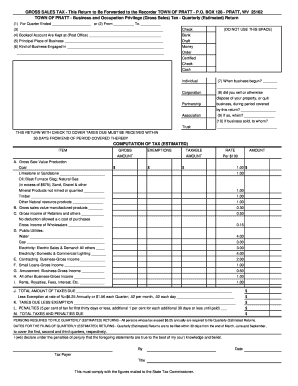

For Investments Placed Into Service On or After January 1 2003. BOX 307 BUFFALO WV 25033 Town of Buffalo - Business Privilege and Occupation Gross Sales Tax - Quarterly. States of Washington West Virginia and as of 2010 Ohio 1 and by municipal.

Department City Collector Document Form BOoverviewpdf 405 KB. Should you need any assistance regarding BO taxes please call 304-725-2311 or email BusinessLicensecharlestownwvus. 222 W Main Street.

8AM to 4PM Closed Saturday and Sunday City Collector Christina Merbedone-Byrd 915. All businesses located in the Village of Barboursville must fill out the Business and Occupation BO Tax Return. Tax Information and Assistance.

ABO Tax returns are due within one month following the end of the taxable quarter. Quarterly payments are due in April July October and January. Penalty and interest will be applied.

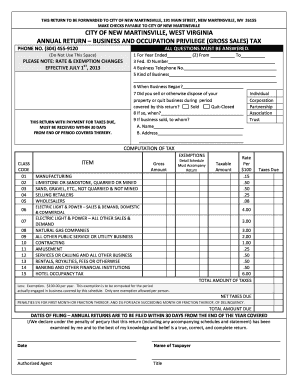

Posted on June 8 2017 The West Virginia Municipal Business and Occupation Tax BO Tax is an annual privilege tax imposed on all persons and entities doing business. FORM 101 - B O TAX this to be forwarded to. Steeles solution for these cities facing the loss of BO taxes is to apply for.

One of those is Summersville where the BO tax makes up about 25 of the citys revenue. Business Occupation Taxes File a BO Return Hours of Operation Monday through Friday. EOTC-A Application for West Virginia Economic Opportunity Tax Credit.

Rate per 100 Gross Receipts Value Production.

Wv Cities Worry About B O Tax Cuts

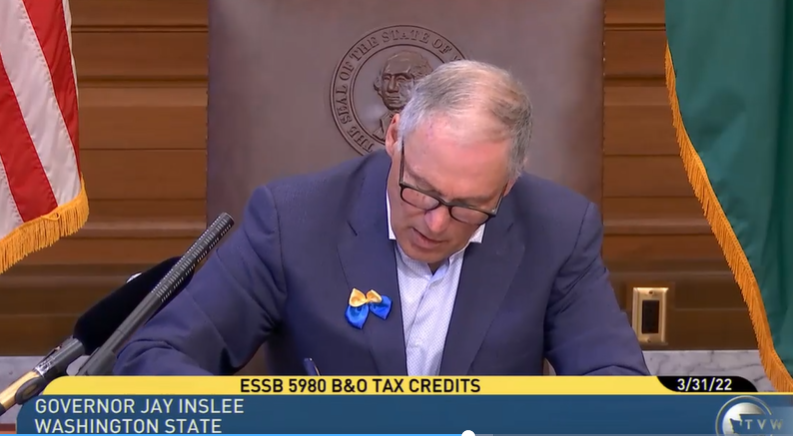

Small Business Thanks Governor For Signing B O Tax Credit Bill Nfib

Is The Proposed Cut To The B O Tax In W Va The Start Of Its Elimination Wtov

Fillable Online B O Annual Form City Of New Martinsville Wv City Hall Fax Email Print Pdffiller

Fairmont West Virginia City Council To Discuss B O Tax Change Fairmont News Wvnews Com

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Belle Wv City Of Belle Wv Walker Machinary Manufacture Of And Repair Of Heavy Duty Construction Mining Machinary The 2nd Largest Employer 2nd Largest B O Tax

City Of Logan West Virginia New B O Tax Forms And Business License Update Forms Are Being Sent Out Beginning August 1st With The Revised Rates All Fees Will Be Due October

City Of Clarksburg Wv B O Tax Form Fill Online Printable Fillable Blank Pdffiller

1201 E Pike St Clarksburg Wv 26301 Officespace Com

Proposed Bill Would Eliminate B O Tax On New Car Sales In West Virginia Wchs

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation

Iata Resolution 788 Eligibility Form Fill Out And Sign Printable Pdf Template Signnow

Huntington City Council Votes To Permanently Suspend B O Tax For Restaurants Retailers Wchs

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

Incentives Martinsburg West Virginia

Chris Tatum Legislature Must Not Starve City Budgets By Eliminating B O Tax Opinion Coalvalleynews Com